Irs Form 1065 Schedule K-1 Instructions 2024 – If you are looking to get on track to becoming a 401(k) millionaire or achieving financial freedom, the IRS has just announced the new 2024 401(k) contribution limits. For those with a 401(k), 403 . the catch-up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), most 457 plans, and the Thrift Savings Plan remains $7,500 for 2024, according to the IRS. .

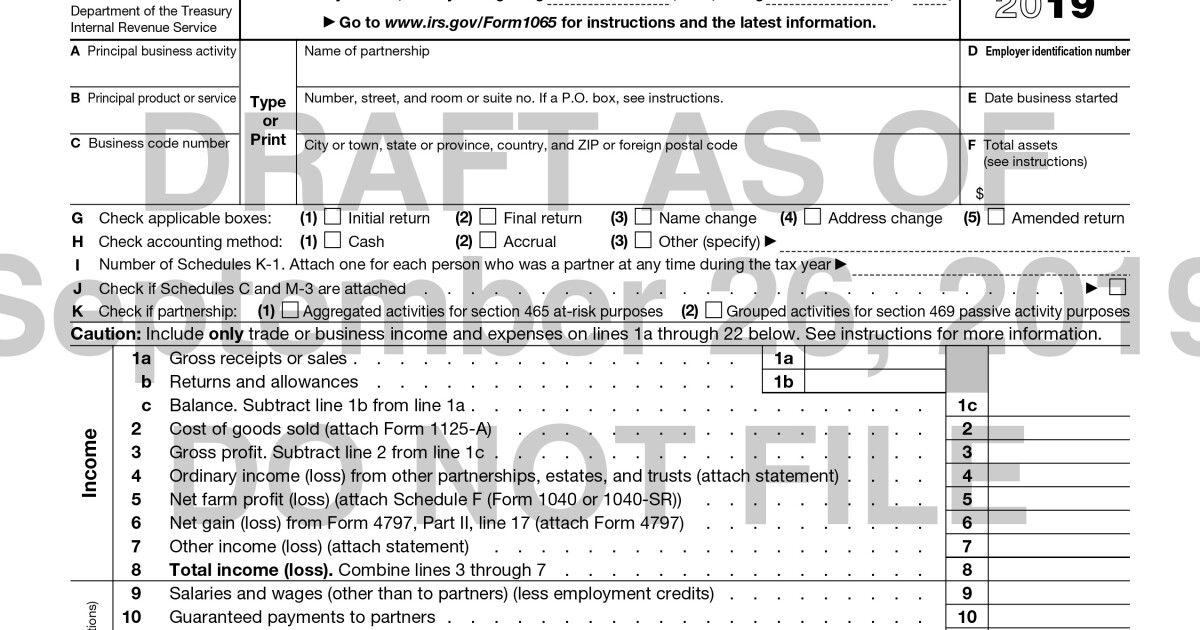

Irs Form 1065 Schedule K-1 Instructions 2024

Source : www.irs.gov

IRS releases drafts of the new Form 1065, Schedule K 1

Source : www.accountingtoday.com

3.11.15 Return of Partnership Income | Internal Revenue Service

Source : www.irs.gov

Form 1065: U.S. Return of Partnership Income—Definition, Filing

Source : www.investopedia.com

3.11.15 Return of Partnership Income | Internal Revenue Service

Source : www.irs.gov

New 1065 Instructions Unveiled bcktaxservices.com

Source : bcktaxservices.com

3.11.15 Return of Partnership Income | Internal Revenue Service

Source : www.irs.gov

2019 Form IRS 1065 Schedule K 1 Fill Online, Printable, Fillable

Source : www.pdffiller.com

3.11.15 Return of Partnership Income | Internal Revenue Service

Source : www.irs.gov

Draft Instructions 2021 Form 1065 Partnership Return | Wolters Kluwer

Source : www.wolterskluwer.com

Irs Form 1065 Schedule K-1 Instructions 2024 3.0.101 Schedule K 1 Processing | Internal Revenue Service: The Internal Revenue Service announced Wednesday that the amount individuals can contribute to their 401(k) plans in 2024 has increased to $23,000, up from $22,500 for 2023. The IRS also issued . Under the new 2024 limits just announced by the IRS, individuals can put up to $23,000 in their employer-sponsored 401(k)s. These accounts are popular retirement savings tools because .

:max_bytes(150000):strip_icc()/Form1065-55a61388dd91421d8736a94d3b20f03e.jpg)